Corn Tech Update

Grain Market Commentary

Wednesday, December 11, 2019

by Jacob Christy, Freedom Program Trader, The Andersons

A tough day for corn futures as speculative selling pressured prices to three-month lows. A lack of trade deal progress, improving Argentina rainfall potential, and no surprises from the USDA report yesterday, gave bears confidence today. In muted volume, March futures fell to within five cents of contract lows.

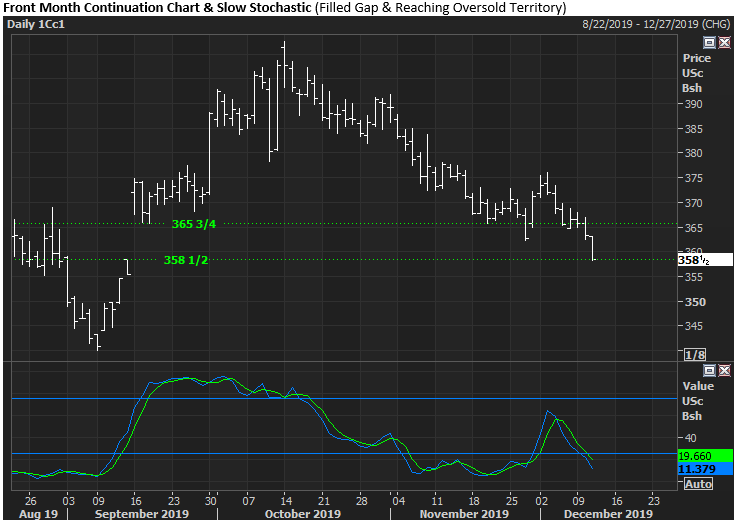

Looking at the chart shows corn remains firmly entrenched in a downward trend. Prices have shown almost no life this month closing lower or unchanged in all but two sessions since December 1st. Front month prices did fill the much-hyped continuation gap from September which could spark some bargain buying. However, without a true catalyst rallies look limited to brief short covering pops.

Corn has been in a downward trend since Mid-October. The lack of a bullish catalyst will keep long term fundamental bears in the driver seat. That said, prices have reached a key downside target and the market has dipped into oversold territory. This could set up for some yearend profit taking. Though the downside may be limited to contract lows short term, the upside looks just as limited.