Corn Tech Update

Grain Market Commentary

Thursday, May 23, 2019

by Jacob Christy, Freedom Program Trader

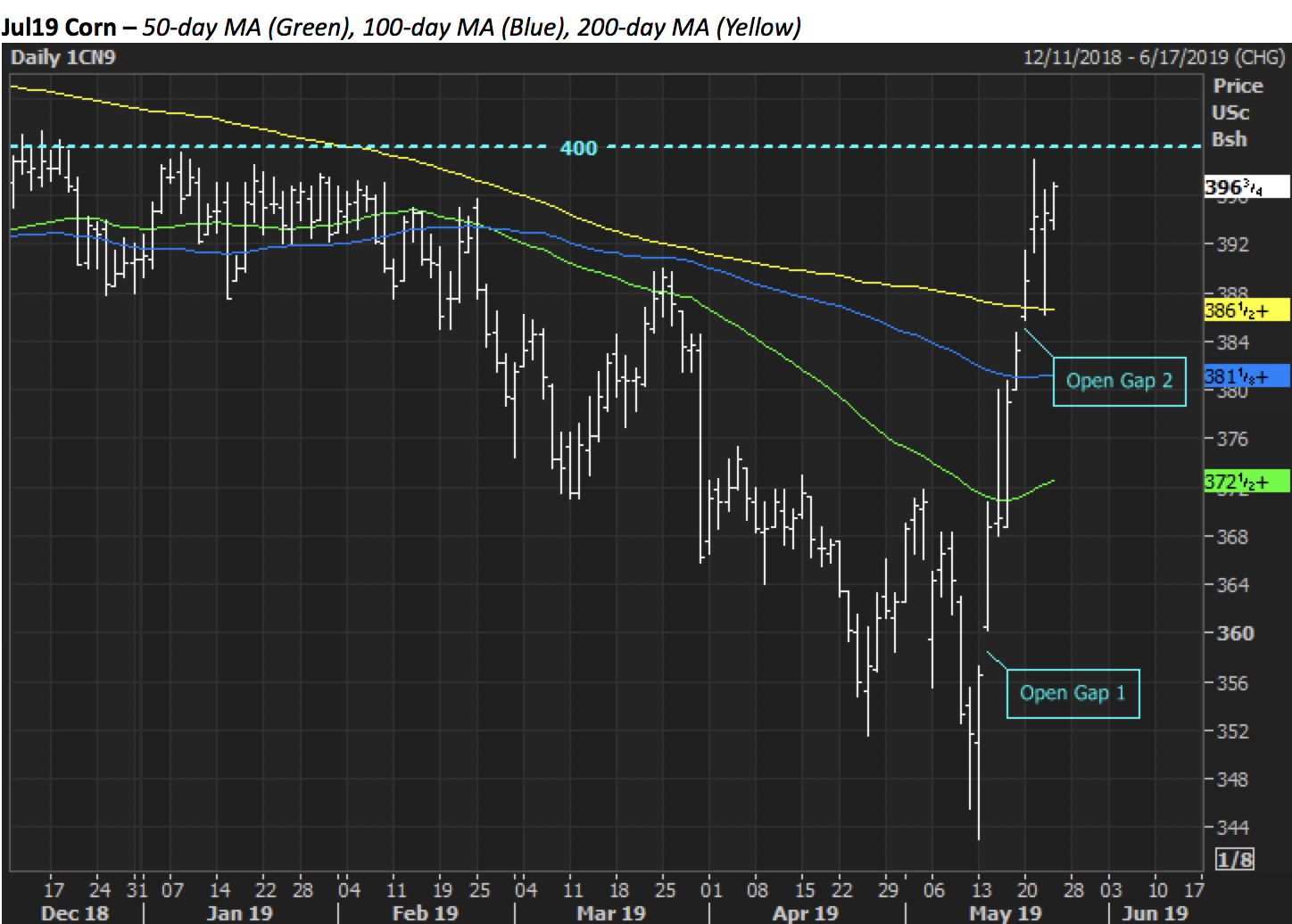

The corn market continues to march on as new crop supply loss concerns grow. Futures have closed higher every day since May13th going from contract lows to yearly highs in eight extremely volatile sessions. Funds have run for the door, aggressively closing what was a record short position. Prices are consolidating for the moment, maybe preparing for the long weekend ahead, but expect more volatility until the market can grasp the magnitude of lost corn acres and yield drags.

53cents, two gaps, and eight consecutive days higher describe the past week and a half. July futures have been shot out of a cannon. The Tuesday night gap over the 200-day moving average, which the market hadn’t been above in 11months, was just another sign of strength. Hard to gauge how much of the funds record short has been covered, but it’s clear the trend is higher, and until they are completely cleaned out, they say the trend is your friend. We’ll keep an eye on the open gap, and 200-day moving average as a close below there would signal consolidation.

Spring 2019 has the potential to be historic. Planting progress is the slowest this decade, and prevent plant acres could be the highest ever. With the funds a record short just a few weeks ago, it’s no surprise the market has seen such sharp gains. The questions now are how many acres are lost? What’s the yield? and will those spark the fund to build a long? The answers to those questions will be the difference between price consolidation at current levels, or another leg higher. Stay tuned.