Corn Tech Update

Grain Market Commentary

Wednesday, April 1, 2020

by Jacob Christy, Senior Merchant, The Andersons

It’s been a one-two punch to remember for new crop corn prices this week. The old crop ethanol demand destruction and yesterday’s USDA acreage estimate have Dec20 on the ropes. In larger than normal volume, selling accelerated today as trade digests what 97million acres could mean for the already ballooning balance sheet.

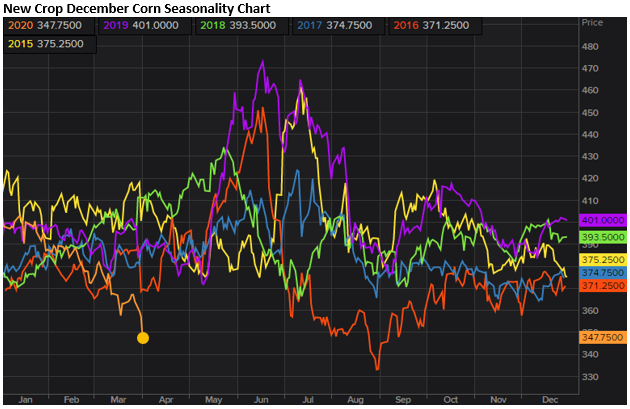

Dec20 futures have closed lower in four consecutive sessions. It was a new contract low again today. At 347, new crop December futures now sit at 14 year seasonal low, and the lowest real price since the fall of 2016. With open interest at multi year lows and overwhelming bearish fundamentals, the illiquid corn market is the perfect place for uninhibited selling.

All is not doom and gloom however.

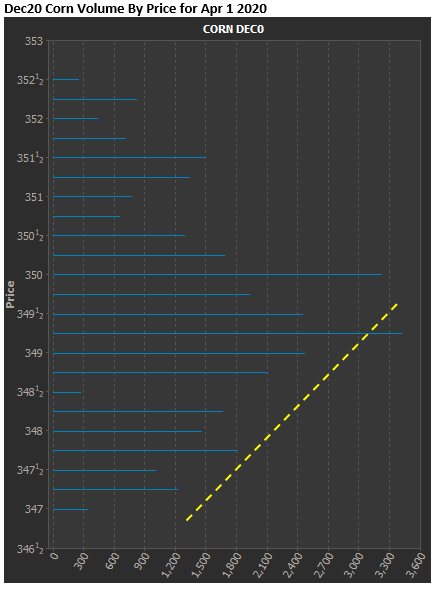

The corn market is dipping into oversold territory, while traded volume waned the further below 350 prices went today. Both indicate willing sellers might be getting harder to come by below 350. Understandable given the amount of bearishness priced in. Holding 350 for the remainder of the week could be a key first step in stabilizing the market.

We’re in uncharted territory. Trade is dealing with things it’s never dealt with or haven’t dealt with in a long time. For now, the knife is falling, without many willing bargain seekers. Keep an eye on 350 to end the week, it could become a consolidating area. If not the 2016 low range from 315-325 offers the next real support. Stay tuned.