Corn Tech Update

Grain Market Commentary

Tuesday, August 18, 2020

by Jacob Christy, Senior Merchant, The Andersons

The corn market has been on a corrective rally since the USDA yield report last week. Without that yield surprise and the market overbought there wasn’t enough bearish momentum for prices to continue to new contract lows. Add in last week’s wind storm the put supplies in question, and risk premium has been added. The rally has now reached an area that re engaged farmer selling and prices have achieved initial upside targets. Let’s take a look at the chart.

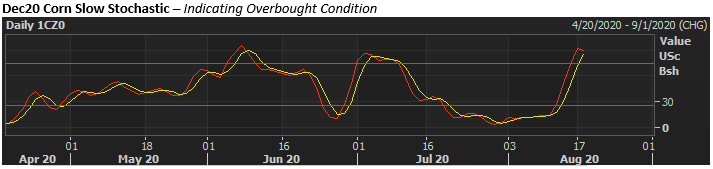

At today’s high the market was 26c off last week’s contract lows. Prices pushed above both the 50-day and 100-day moving averages while also filling the open July chart gap left over from a surprise jump in ratings last month. After the four-day 26 cent pop, the market has swiftly moved from oversold into overbought territory. With such a move some consolidation isn’t surprising.

From here it will be important for prices to hold the recently broken resistance. The market had to work hard to clear the moving averages and giving back that momentum within three day’s would be a blow to recent bulls. The moving averages also mark the bottom of the main Fibonacci band, which may end up representing the consolidating range. This makes 337-338 a key support this week.

To the upside, filling the open chart gap leaves the combination of the 200-day moving average and early July highs as the clear upside target. 350 might hold a psychological edge, but other than some willing sellers, the mark doesn’t jump of the chart.

Corn has had a nice corrective bounce off contract lows and now sits in the middle of its July range. The overbought condition might lead to some consolidation this week with the recently broken moving averages eyed as key support. From here a lot will depend on yields. Until then, there are some clear chart areas we’ll want keep an eye on. Stay tuned.