Special Market Update

Grain Market Commentary

Wednesday, February 19, 2020

By Greg Johnson, Senior Originations Merchant, The Andersons

2020: A Year to Play Aggressive Defense

2019 – the year in review

March 2020 corn futures started 2019 at $4.07. It finished the year at $3.88, down 19 cents for the year (down 4.7%). Currently, March futures are $3.81, which is down 7 cents for 2020 thus far.

March 2020 soybean futures started 2019 at $9.53. It finished at $9.55, up 2 cents for the year (up 0.2%). Currently, March futures are $8.96, down 59 cents for calendar year 2020 thus far.

July 2020 wheat futures started 2019 at $5.56, and finished at $5.63, up 7 cents (or up 1.2% for calendar year 2019). Currently, July 2020 wheat futures are $5.59, down 4 cents for the year.

Where do we go from here?

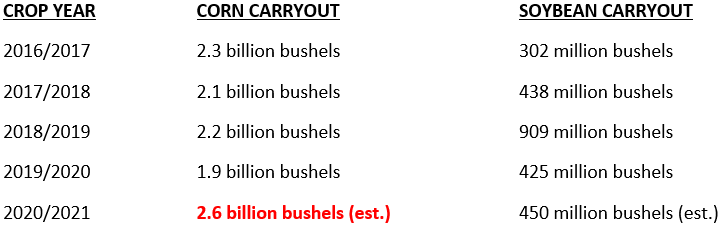

CORN – Ending stocks for the 2019/2020 crop (the crop that is currently in the bin) is projected to be 1.9 billion bushels. This is less than the previous 3 years, but is still more than comfortable. See table below:

BEANS – Ending stocks for the 2019/2020 crop is projected to be 425 million bushels. While this is more than adequate, given the projected big South American crop, it is less than half as big as what was projected by the USDA back in June 2019 (1.0 billion bushels).

Note the large corn carryout projected for the upcoming crop. This assumes that we will plant 94 million acres of corn, up 4 million acres from last year. It also assumes a normal trend-line yield, which is where we start every spring. Our projections expect demand for corn to increase 700 million bushels (due to the lower price of corn, as well as expectations of increased Chinese demand of ethanol, DDG’s, and corn). Even so, corn ending stocks could be the highest we have seen in many years.

Soybean acres are expected to be 84 million acres, up 8 million acres from last year. The Chinese demand for U.S. soybeans will be the big wild card. Will the U.S.-China trade deal result in a return to over 2 billion bushels of soybean exports, as we saw in 2016/2017 and 2017/2018? Or will exports remain around 1.8 billion, as they have been the past 2 years? We may not know the answer to this question for some time, but the hope of increased Chinese demand may allow soybean prices to remain relatively stable.

What to do

In order to avoid the potentially lower corn prices that a 2.6-billion-bushel carryout could bring, it will be important to “play defense.” Playing defense does not mean doing nothing. It means:

- Get realistic offers in to get both old crop corn and new crop corn sold.

- Enroll bushels in our Seasonal Daily Averaging program, which prices bushels when the prices are historically at their highest.

- Lock in floors, while retaining upside price potential. This can be accomplished by using our min/max/averaging programs. These programs guarantee that your corn will not be priced any lower than the minimum price you select, while allowing you to have upside price potential, should we encounter a run-up in prices throughout the year.

Talk to your Andersons account representative, and get ready to play “aggressive defense.”