Weekly Market Wrap-Up

Grain Market Commentary

Friday, January 18, 2019

by Jay Smith, Grain Associate, The Andersons

More of the same this week as a lack of fresh fundamental data has left the markets choppy and volatile. The government shutdown, trade, and South American weather patterns continue to dominate headlines and ultimately drive markets. There is still no end in sight for the shutdown, which continues to delay key USDA data including the January crop report. The shutdown has left the market blind to export data and fund positions. With no clear picture on final production, exports, and fund positions it has left both buyers and sellers unwilling to stick their necks out too far, which makes it hard for the markets to pick a direction. Trade has also put pressure on the markets as the U.S. said early in the week that trade talks with China did not produce the progress that was anticipated. But, late in the week a Wall Street Journal article was released saying the U.S. was considering lifting some, if not all tariffs against China to reach a trade agreement. Conflicting information was released following the articles release and it is hard to confirm with the government shutdown. Regardless, the markets were excited about the potential, and it also shows just how sensitive the markets are to tweets, headlines, etc. South American weather remains relatively unchanged from last week. The impacts of dryness on yields remains a topic of debate as weather for most of the growing season was ideal, but wet weather would still be welcomed by them. Until more is known, expect the markets to hold on to some type of risk premium moving through the South American harvest. As the markets continue to lack fresh news, expect their weather patterns to remain drivers.

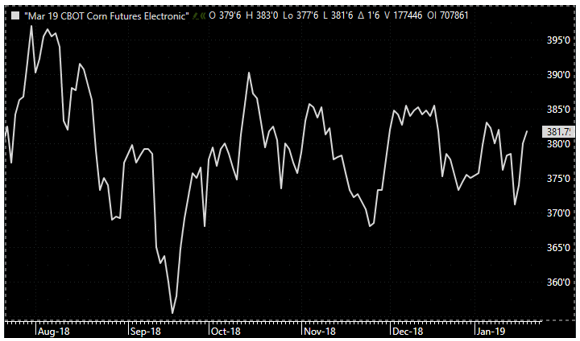

March corn opened the week at $3.78 and closed at $3.81. A 3-cent increase. Prices hit the low end of longstanding ranges early in the week, but prices recuperated as the week progressed due to bargain buying and trade war rumors. The 100 and 50 day moving averages are sitting right above the market which will be interesting to watch if corn established new ranges. There were unconfirmed rumors late in the week that China was looking into U.S. corn bids which did provide a pop to corn prices.

March soybeans opened the week at $9.10 and closed at $9.16. A 6-cent increase. The market is tired of waiting for the government to reopen and for the Chinese to return to the U.S. market, contributing to the choppy rangebound movement. Like corn, there were unconfirmed rumors late in the week that China was looking into U.S. soybean bids which did provide a pop to soybean prices.

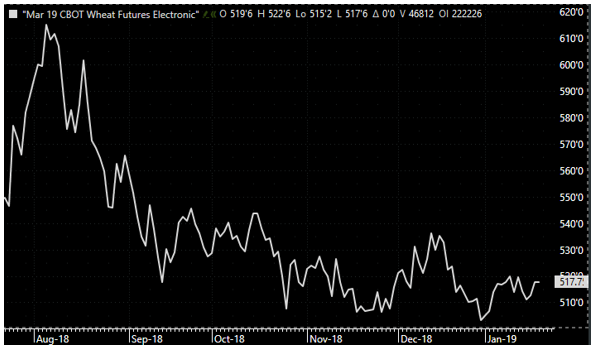

March wheat opened the week at $5.20 and closed at $5.17. A 3-cent decrease. Unconfirmed rumors that China has purchased U.S. wheat got the market very excited late in the week.