Weekly Market Wrap-Up

Grain Market Commentary

Friday, June 21, 2019

by Jay Smith, Grain Associate, The Andersons

The week started up sharply on the back of ongoing weather concerns. Heavy rains over the weekend carried into a cool and wet seven-day forecast leaving little to no room for further planting progress. Volatile markets continue as it looks as if corn planting has all but come to an end. It is now going to be the job of the market to attempt and digest acreage loss and yield decline. The planting progress report fell in line with the average trade guess this week. The markets are deeply overbought, the midweek declines may have just been a sign of fatigue from the markets after the recent run ups over the last month. Buying interest waned which gave way to profit taking. This is not necessarily a shift in the fundamentals but more so consolidation and profit taking as we approach month end, quarter end, and the important June acreage and stocks report next week. Late week weather models did not turn worse and showed the return of normal temperatures for most of the corn belt. Heat will be critical as the crops that have made it into the ground will need to quickly begin to amass growing degree days. Overall, not much risk premium was taken out of the market as the entire U.S. growing season still lies ahead.

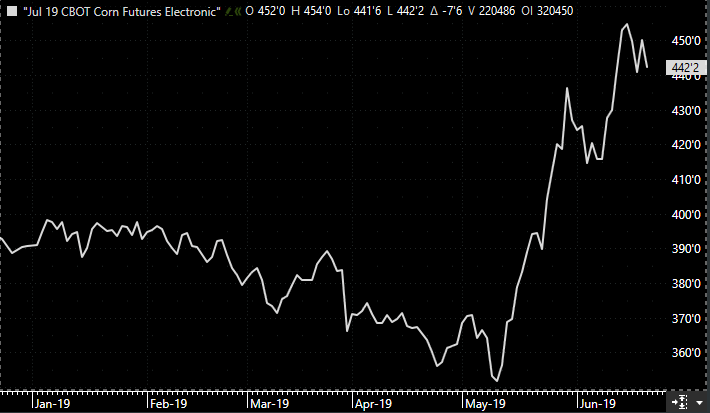

July corn opened the week at $4.58 and closed at $4.42. A 16-cent decrease. Early week corn futures rose to their highest levels since 2014 on the back of ongoing weather concerns. The crop progress report had corn at 92% planted, compared to 83% last week and the five-year-average of 100%. Of the 18 largest corn producing states, Ohio is the biggest percentage laggard at only 68% planted. Corn good to excellent ratio remained at 52% week over week compared to 59% at this time last year.

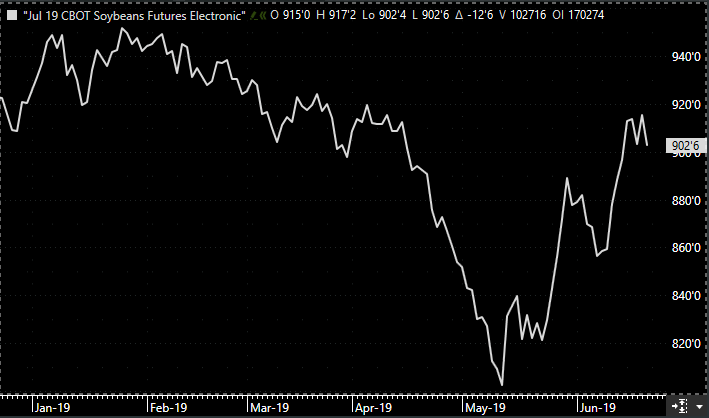

July soybeans opened the week at $9.01 and closed at $9.02. A 1-cent increase. Early week beans also rose sharply higher due to the planting concerns now making their way into the market. Even though the planting window is later than corn, the extended forecast is starting to raise some concerns. The plant progress report had soybeans at 77% compared to 60% last week and the five-year-average of 93%. To this point, this is the 3rd slowest planting pace in the last 20 years.

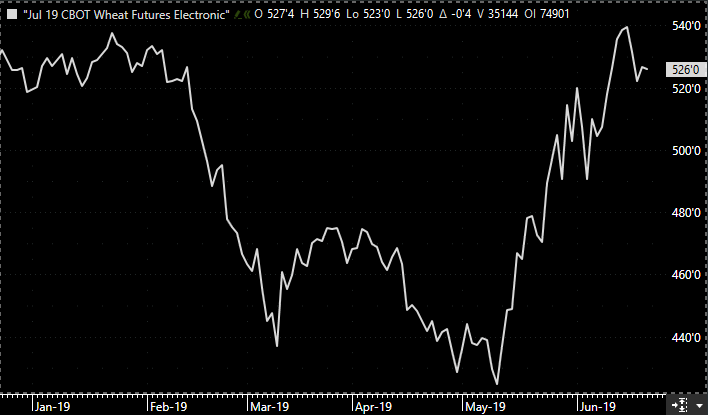

July wheat opened the week at $5.40 and closed at $5.26. A 14-cent decrease. Early week wheat rose to a 9 ½-month peak, being lifted higher by the gains in corn and soybeans but ultimately fell due to profit taking and strong competition in the export market.