Weekly Market Wrap-Up

Grain Market Commentary

Friday, March 22, 2019

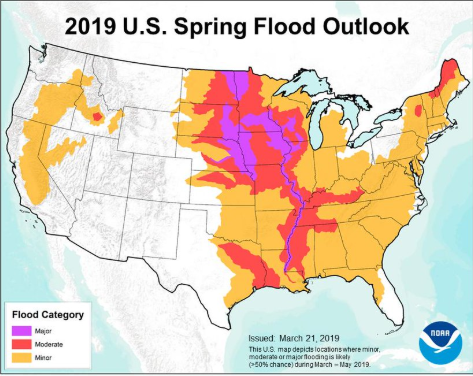

by Jay Smith, Grain Associate, The Andersons

The CFTC report released last Friday after the close revealed massively short positions as of Tuesday the 12th. But, we do know there was a fair amount of short covering that took place as the week progressed. Even with the short covering, funds were holding on to near record net short positions. U.S. weather moving forward will be closely monitored as the forecast will need to dry up moving through the end of March into April or some risk premium may need to be added to the market. Overall, there are just enough U.S. weather concerns, optimism in trade, and uncertainty over the acreage mix to keep the shorts uneasy. It looked as if there were no fresh reasons to cause a short covering rally until the end of the week. Chinese purchase rumors, NOAA’s spring outlook report, and President Trump adding to the trade optimism caused some rapid short covering in corn.

May corn opened the week at $3.74 and closed at $3.78. A 4-cent increase. Last week’s CFTC report revealed a record short in corn with a new record of 90,000 shorts being added to the corn markets alone. Argentina has its largest vessel lineup for corn in its country’s history. This has a direct impact on U.S. competitiveness as other country’s simply have cheaper origin options for corn. Corn did see large volume short covering towards the end of the week. The Chinese corn purchase rumors were backed up by firming cash markets. Also, the NOAA’s spring outlook brought attention to major flood risks across the western corn belt. Corn was caught a little too short with fresh fundamentals starting to pile up.

May soybeans opened the week at $9.10 and closed at $9.03. A 7-cent decrease. The flooding in the plains and the extended U.S. weather forecast are to be closely monitored as we head into planting season to see if it effects the bean acreage mix. The NOAA report predicts major flooding risks for a large portion of the western corn belt which would almost certainly cause those acres to be switched to beans. Weekly export number numbers were lower than expected adding caution to trade optimism for now.

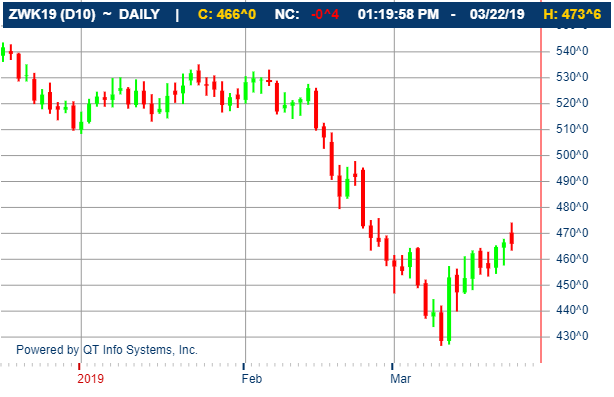

May wheat opened the week at $4.63 and closed at $4.66. A 3-cent increase. The flooding out west is being closely monitored to see if it influences winter wheat yields. Weekly export sales of what fell within expectations.