Soybeans Tech Update

Grain Market Commentary

Wednesday, December 18, 2019

by Jacob Christy, Freedom Program Trader, The Andersons

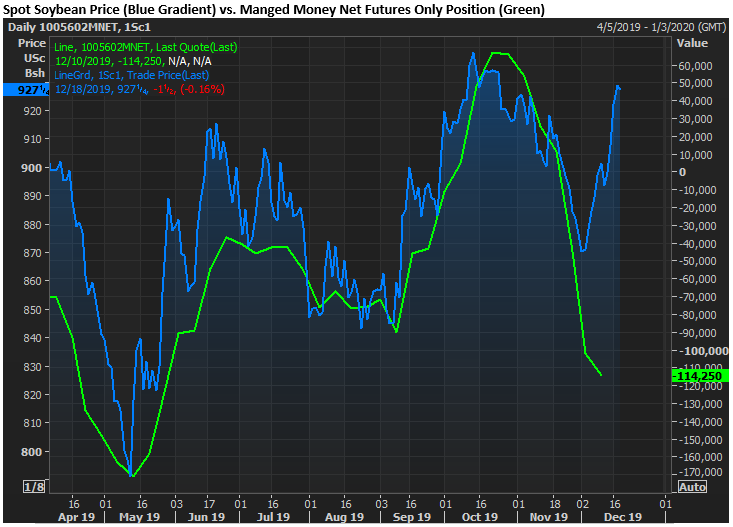

Beans see their first lower session since Friday’s announcement of a phase one trade agreement between the U.S. and China. Growing optimism a deal might be near completion had beans forge a strong bottom earlier this month. However, it wasn’t until Friday’s confirmation that short covering really ramped up.

January 20 futures scored a picture perfect “V” bottom earlier this month that nicely matched the late-summer lows. Forging that trend reversal bottom allowed prices to bounce 30c to test the psychological 900 mark. Consolidating action took over just below 900 as interim upward momentum stalled. That was until the one-two punch of the phase one trade agreement and a COT report showing managed money holding their largest futures only short in seven months (-114K contracts, see below).

Prices subsequently gapped higher Sunday night, jumping over the previously hindering 900 mark. Short covering continued and prices surged until today as the market took a quick breather. Futures have reached previous high-volume targets while quickly moving into overbought territory. Given this, some consolidation isn’t shocking.

From here trade will be looking for China to take its initial steps towards reaching the agreed upon import target of an ambitious 40-50 billion dollars. If those happen, there’s still plenty of speculative short left to cover which could bring a test of the markets double top at 960. On the flip side if the market loses faith in China’s commitment, expect some, or a lot, of air to be let out. Stay tuned.