Corn Tech Update

Grain Market Commentary

Wednesday, September 4, 2019

by Jacob Christy, Freedom Program Trader, The Andersons

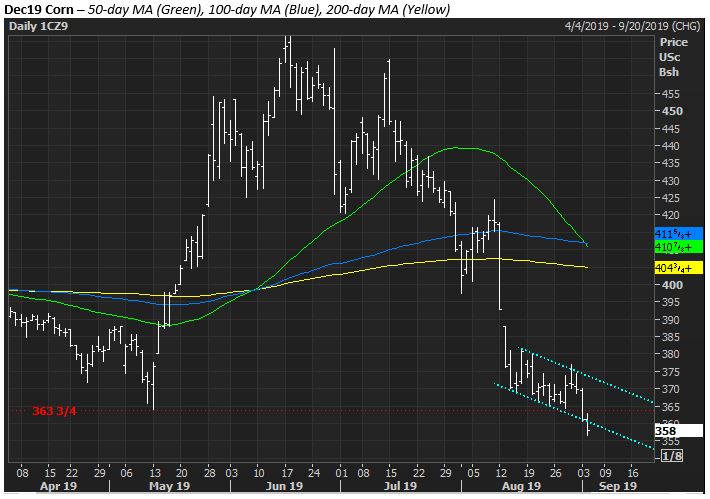

Another day, another new contract low for corn. Warmer weather along with abysmal export demand have allowed funds to push prices with little buying interest. A late surge in beans and wheat allowed corn to finish off the session lows today but still in the red.

Corn has had a pretty rough go since the August crop report just over a month ago. Prices have fallen in 12 of the 16 sessions since the report’s release, dropping 60c along the way. Despite a deeply oversold condition, the market has struggled to find a foot hole. What little life prices have shown has quickly been snuffed out.

With that said, the declining volume seen at lower price levels indicates we may be running out of sellers. Open interest patterns also suggest long liquidation is slowing. New shorts entering the market will be needed to push prices further. With the divergence in volume and the trend in open interest, that new selling might require fresh stimulus to entice.

There are some initial signs a reversal is near, but there’s not sugar coating it, the corn trend is lower. Momentum is lower. The path of least resistance is lower. The chart looks bad. Seasonal trends show corn does try to make interim lows around this time. However, unless the market is given a reason to buy, the trend will remain the market’s friend.