Soybeans Tech Update

Grain Market Commentary

Tuesday, August 11, 2020

by Jacob Christy, Senior Merchant, The Andersons

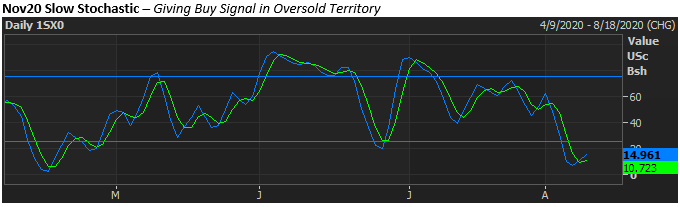

Beans up for a second day this week helping reassure trade that prices would hold key support until seeing Wednesday’s USDA production update. The market had nice reversal action to start the week which prices built upon today. Momentum indicators also helping by giving buy signals out of oversold territory. Now we’ll see what type of yield the USDA gives for short term direction.

Depending on how you draw the five-month ascending trendline, prices did basically hold it this week. The 100-day moving average was also held, without drawing nuances, and got confirmation today. So a good test and a good hold for initial support in the bean chart. And if it wasn’t for tomorrows USDA report the market might have had even more upward momentum.

As for objectives from here prices have respected the longer-term moving averages for a while now. That makes the 100-day at 870, and the 200-day at 903 pretty clear targets. Falling below the 100-day could open the door for a washout trade to the old congestion area from 840-860. While getting above the 200-day for the first time all year would definitely spark some new bullish momentum.

We’ll see what the USDA has in store tomorrow. Keep an eye on the moving averages as an early signal to a shifting trend. Stay tuned.