Corn Tech Update

Grain Market Commentary

Wednesday, August 5, 2020

by The Andersons Risk Management Team

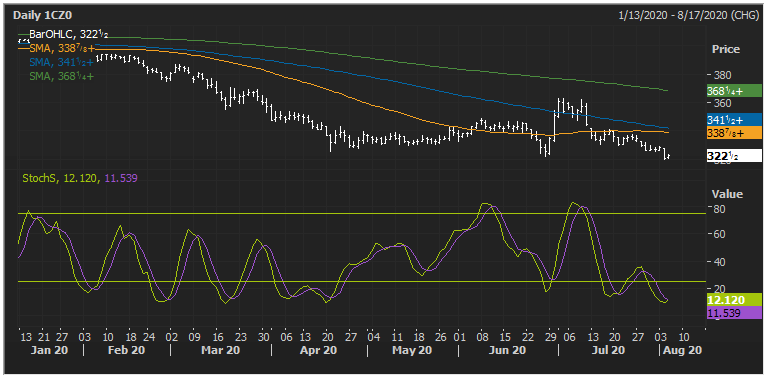

Today we are going to take a look at what appears to be the beginning of a technical momentum shift out of oversold territory in CZ20 chart on the close. The market has once again reached oversold territory in response to the last several sessions of heavy selling pressure. Today marks the potential of a turning point in that selling pressure as December corn has traded into new contract lows and has started to recover. This generally means that the momentum of market selling is slowing to a degree large enough at a price low enough (today) to trigger some technical buying for a small recovery.

It’s imperative to equally understand that we are heading toward the August WASDE in the short term that may wreak havoc on any technical buying to play out long term if yield exceeds market expectations. August yield forecast is usually rather high as the crop hasn’t finished out yet and stands appear to be pretty good. A fundamental data point does have the potential to take the wheel away from technical, but strictly viewing the timing, it’s safe to this this cross of the stochastic as short term supportive.

Lastly, if a recovery were indeed to take place, even for a week, it should create catch-up selling opportunities for a portion of unhedged production. If the market were able to regain the 16-20 cents needed to near the 50-day, this should be viewed as a selling target as the market has struggled to maintain a rally above that level, this also converges nicely where the gap is from earlier this month. Given the notable improvement in weather, the market appears to be digesting larger yield potential that feared just 3 weeks prior, this would support mitigating some risk at those price points moving forward.