Soybeans Tech Update

Grain Market Commentary

Tuesday, November 17, 2020

by The Andersons Risk Management Team

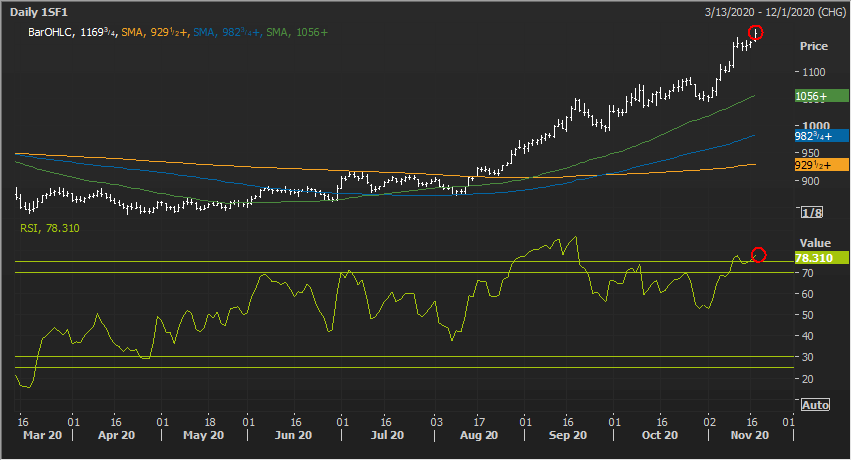

The environment soybeans find themselves in is anything but technically driven, that said, how far can beans go? With demand fueling the rally, as opposed to supply, it’s very difficult to quantify how much demand is needed, but we are approaching some signal of at least a slowing of the rally. Stochastics crossed late last week while RSI (Relative Strength Index) continues to perform and support the move higher.

First indication of momentum shifting is comparing the futures contract high to the RSI high for each day, Tuesday is starting to send an interesting signal that that momentum is slowing but has yet to trigger an RSI sell signal. If, in the next few sessions, SF21 makes new highs with the RSI failing to keep up; the technician would view that market movement and bearish.

Fundamentals have the ability to offset most technical data with more flash sales or threats to current /future supply, but speaking purely from a technical perspective, the market would be indicating there is less appetite for continued buying. With fund length rather large, especially for this time of year, any slow of momentum could be the precursor of a short-term selloff.