Corn Tech Update

Grain Market Commentary

Tuesday, September 22, 2020

by Jacob Christy, Senior Merchant, The Andersons

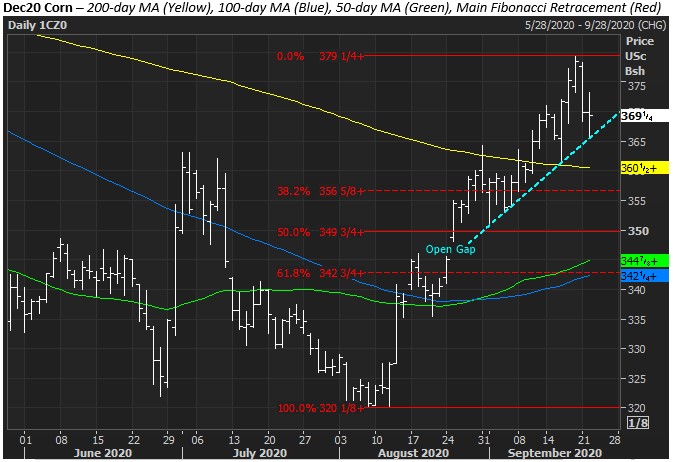

Another consolidating session for corn, which scored a lower low and lower high for a second consecutive session. The market had been on a strong push, but now looks susceptible for some level of correction. Let’s take a look at a few short-term downside targets.

Initial support was actually held overnight at the most recent trendline. Below there the 200-day moving average will be the first true support. The market struggled for a long time to get above the 200-day, how easily prices fall through the indicator, if at all, will be telling. The 200-day also lines up with some old highs, making the 360 area a strong consolidation target.

The other major moving averages will also be keyed on, as both the 50- and 100-day now lie in last month’s open chart gap. This unique combination of major moving averages within an open chart gap will be clamored about by technicians. Falling below 360 will fuel the call to close the gap.

Outside of that, in any corrective phase the main Fibonacci retracement is a good place to start looking for targets. For Dec20 corn futures the main fib band sits between 342-356, with the 50% retracement at 350. The psychology of 350 might also reinforce the mark as a support. However, with the chart gap just 4c below it, if 350 is attained it’s hard to see the market not at least testing the gap.

Corn has been on a nice run since last month’s contract low reversal following the August 12th USDA report. The rally however did push the market into deeply overbought territory, and with looming U.S. harvest some consolidation is likely, if not overdue. The market needs to re-engage new buyers. We’ve outlined a few areas in the chart where that could take place. Stay tuned.