Special Market Update

Grain Market Commentary

Tuesday, December 15, 2020

by Rhett Montgomery, Associate Merchant, The Andersons

Corn

March corn (CH21) traded 0.75c higher today, closing at $4.2575. New crop 2021 December corn (CZ21) traded 0.5c higher, closing at $4.12.

The market continues its sideways trade today as last Thursday’s WASDE report was quickly digested by the market. The USDA left the corn balance sheet for 20/21 unchanged with ending stocks still projected at 1.7B bushels. The big questions looming over the corn market as we enter 2021 are 1) When does the huge export sales the U.S. has on the books turn into actual shipments and 2) What do corn plantings look like for 2021. It seems clear that the market has priced in large export sales as much as it feels comfortable with without seeing those sales turn into actual export shipments. Right now the pace of inspections is slightly lagging behind pace needed to meet the USDA estimate, but if we should start to see these shipments pickup in a way similar to beans earlier this year, that should mean another leg higher in front month futures barring no demand destruction in other places, ethanol being the concern if another wave of COVID-19 were to shut down driving/fuel demand.

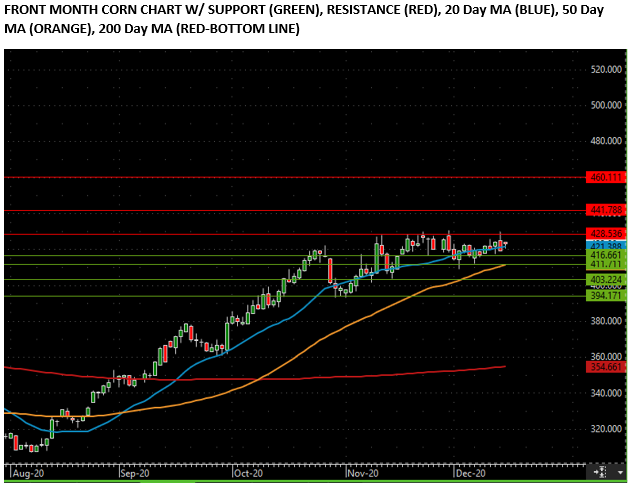

In technicals, front month corn charts have the move clinging very tightly to the 20-day moving average. Support to the downside is at $4.11 to $4.16. Beyond that at $4.03. Any move to the upside would have targets of the past month high of $4.3050. Beyond that the summer 2019 highs of $4.40 to $4.60 would be targets on any bullish demand news.

Soybeans

January soybeans (SF21) traded 14.75c higher today closing at $11.8425. New crop 2021 November soybeans (SX21) traded 6c higher closing at $10.65.

It was a two-sided trade today as nearby beans posted at 23c range. Like corn, beans are stuck in a lull right now not uncommon to December and the Holiday season. Demand remains the story in beans, particularly with China as the vast majority of exports will look to head to China. There are some concerns over crush demand as margins have become tighter with the run up in futures. U.S. beans are expensive to China right now but with Brazil being out we stand as really the only option. Weather in South America continues to be a daily story as it remains dry but the affected areas have been narrowed down in the past week or so due to decent rain coverage for key growing areas. This combined with the battle of acres in the U.S. there should be plenty of rumors and news to drive the trade during the first part of 2021.

In technicals, the market today set a high for the month of December. The next target to the upside would be the late November highs of $11.99. Obviously the $12 mark will be a key psychological level, a sustained move above $12 could set a new landscape for potential soybean prices given the current carryout sub 200M bushels. Support for any potential selloff would be seen at $11.43 and below that the 200-day MA at $11.15 may be a downside target on a bearish surprise. Remember that the market traded 40c higher in one session on November 10th so a reverse move would most likely come in chunks if any bearish news were to hit.