Special Market Update

Grain Market Commentary

Monday, January 13, 2020

By Rhett Montgomery, Associate Merchant, The Andersons

Corn

March corn traded up 3.75c to start the week, closing at $3.8950. New crop December corn closed at $4.0425, up 2.75c. Friday’s WASDE report had some surprises but the net effect was more or less neutral, something that many traders expected with a lot of unknowns still looming in the coming weeks and months that will be much more impactful to the corn market moving forward. In a move that was somewhat surprising the USDA actually raised the supply side of the balance sheet by adjusting the yield higher and increasing beginning stocks. However, what was most surprising about the report was that despite the increase in supply the USDA still cut ending stocks by 18M bushels by raising demand figures. It was the opinion of many in the trade that the USDA would release a neutral report by cutting 2019 production while simultaneously cutting export demand for the crop year. While the USDA did lower export demand by 75M bushels, they more than offset the cut with a 250M bu. increase in feed and residual usage.

The quiet report on Friday makes sense considering the many unknown factors that will come to the forefront in the coming weeks; Firstly, the signing of Phase One of the trade agreement with China is fast approaching, due to take place on Wednesday of this week. The USDA chose not to account for any potential increased ethanol or corn exports to China in Friday’s report, as even with the signing this week, recent comments by the Chinese government that they will not increase corn import quotas and concerns over their ethanol mandates leave big question marks on how much of an impact on the U.S. corn balance sheet this trade deal could have.

Another story that is constantly developing is dwindling South American corn supplies as well as growing conditions in Brazil and Argentina with their harvest approaching. Although the growing season so far in South America has been uneventful these last few months will be key in seeing what size crop will be produced and will obviously play a very important role in U.S. exports business.

Lastly, the market will continue to watch for estimates on prospective corn acres that will be planted this spring. In the months between now and the official plantings report at the end of March, the battle of acres between soybeans and corn will be something that will always have the potential to move the market as analysts throughout the trade begin to make their estimates of how many acres of corn will be planted this spring. The consensus right now is for increased acres year over year, 96M acres seems to be a common figure used. However, as 2019 showed us a lot can happen in just a month or two in terms of weather that can completely change the scope of a crop year.

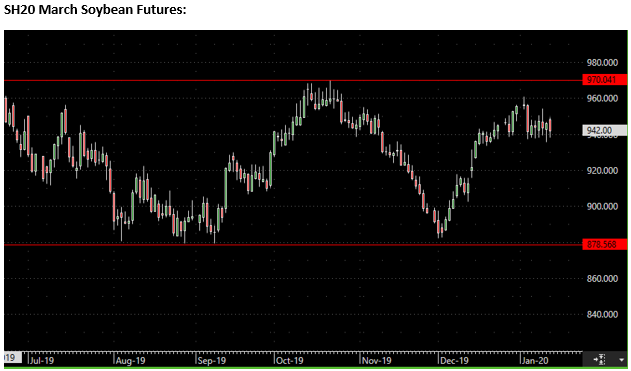

Soybeans

March soybeans traded down 4.75c to start the week, closing at $9.4125. New crop November soybeans also traded lower, closing at $9.6950 down 5.25c. Much like corn, Friday’s report was more or less a non-event for soybeans as the market continues its consolidation that began in the sessions leading up to the report. It is clear that the USDA is waiting on more commitments to develop between the U.S. and China in regards to Phase one of the trade agreement before putting anything official into a report. The signing of Phase One of the trade agreement on Wednesday would definitely be seen as a step forward towards China’s potential commitment to import $40 billion worth of U.S. agricultural goods. However, it is worth being cautious heading into Wednesday as should the signing be delayed as many events in this almost 2 year process have been, the market would have very little patience. It has become clear that market participants want a concrete agreement and commitments from both sides. Also similarly to corn, the coming months of South American weather and U.S. weather into our planting season will be something the market will be watching closely and will set the stage for the remainder of the 2019/2020 crop year.

For now the market is sitting in the middle to upper part of the range that it has settled into for the past year. If we are to see a move higher towards the late October highs of $9.70 March futures, the signing of Phase One of the trade agreement will be a necessity. If nothing is accomplished in terms of an export program heading into an estimated record large South American crop, as well as increased U.S. planted acres, the downside target looks to be in the $9.00 area in the mid to long term.