Special Market Update

Grain Market Commentary

Monday, January 27, 2020

By Rhett Montgomery, Associate Merchant, The Andersons

Corn

Corn futures closed down 6.75c to start the week today, with March corn (CH20) closing at $3.8050. New crop December corn (CZ20) closed down 3c at $3.9525. The markets continued to pile on to Friday’s disappointing close today with the feature being growing concern over the coronavirus outbreak in China and the biosecurity risks it poses. Corn export sales late last week were decent but overall the total volume sold to date is the lowest in several years, dating back to the drought year of 2012. With South America harvest just down the road, and the ongoing biosecurity issues in China, the U.S. will need continued weeks like last week to meet the USDA estimate of 1.775 billion bushels exported. That number today seems to be accurate given the current pace but how the next few months shake out with S. American weather and potential trade with China will go a long way in determining if we meet or miss that estimate. In a more long-term outlook, early estimates of U.S. planted acres and demand moving forward paint a more and more bearish picture. Assuming planted acres of 93M (seeing estimates of 95+), trend-line yield of 176 BPA, and using an increased demand scenario assuming a recovery in U.S. exports, we end up with an ending stocks number north of 2.5B bushels. Obviously, there are a lot of events that go into making a crop and we are very early in looking at 2020/21 numbers, but it is worth keeping in mind what the scenario looks like down the road.

In technicals, the market was overbought in the short term and the scare in the market stemming from the spreading coronavirus epidemic in China was enough to spark the selloff today. The downside target for the move would be the low from the blowout on the 16th of $3.7525. Beyond that the next level of support would be the mid December low of $3.71. Should we see the market stabilize in the coming days the upside target would be to fill the gap that was created on the open last night with a move up to $3.8650. Overall, I look for the market to find a short-term bottom either today or in the next few sessions, stabilize, and continue to trade sideways within the range that has been the feature post-harvest.

Soybeans

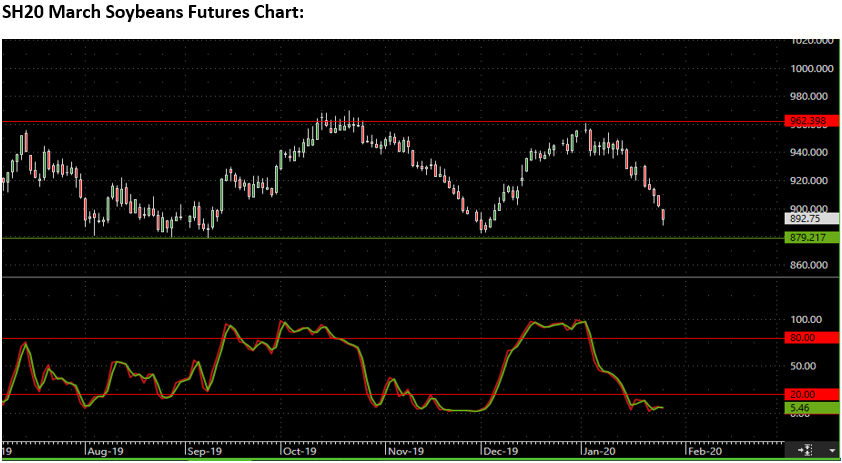

The soybean market continues its sharp downward tumble posting its 8th down day out of the last 10 sessions. March soybeans closed down 4.5c at $8.9725. New crop November soybeans closed at $9.3350, down 5.25c. The main driver of the downslide in soybeans has been the absence of any commitments from China post the Jan 15th signing of phase one of the trade agreement. The market was fully expecting a “good faith” purchase from China in the days immediately following the signing, and simply lost patience when it never came. Adding the coronavirus outbreak to the equation is further pressuring things to start the week. There are big fundamental questions that will be answered in the coming months in regards to the soybean market ranging from South American harvest and crop conditions, to China trade in the face of African swine fever and now coronavirus outbreaks. The upcoming election in the U.S. also will play a big role in the timing of China’s execution of imports laid out in the trade agreement. It appears right now that economically and politically it makes more sense from China’s point of view to simply wait to make heavy commitments to import U.S. beans until U.S. harvest season when A) Ample U.S. supplies cheapen price, and B) The outcome of the U.S. election will become known.

In technicals, the market seems to be oversold in the short term. However, downside support really doesn’t appear until the early December low of $8.8275. Any move upward at this point would be met by resistance most likely at the $9.00 level as well as around $9.25 where the majority of the major moving averages are grouped. Overall, I look for the market to find a bottom here most likely near the $8.80 level and we should see some stabilization considering the current oversold state of the market as indicated by the stochastic oscillators.

Key Takeaways:

- Markets sharply lower to start the week on growing coronavirus concerns in China and its effect on U.S.-China trade.

- Long term outlook for grains is bearish given current balance sheet projections.

- South America harvest/U.S. planting will soon become the feature of day to day trade.

Please tune in to andersonsgrain.com for more market updates.