Special Market Update

Grain Market Commentary

Monday, September 21, 2020

by Rhett Montgomery, Associate Merchant, The Andersons

Corn

December corn traded 8.75c lower to start the week, closing at $3.6975.

It was a day of profit taking in grains as corn had only its fourth down day in the month of September. Since the August 12th WASDE report December corn rallied from a low of $3.20 to $3.7925 on Friday. The sharp uptrend has the market overbought in the short term while the fundamental picture remains fairly bearish overall in the long term with a carryout still north of 2.5B bushels even with the supply cuts in the report on the 11th. For the past several sessions corn has felt like it is along for the ride with soybeans on lack of fresh news to drive it higher by itself.

The U.S. does continue to sell corn to China, and the Chinese Ag Ministry raised its estimates for corn imports over the next two marketing years to accommodate higher imports from the U.S. The market will begin to look to the September 30th Stocks Report as well as early harvest yield results as a driver for the market moving forward.

Overall, the corn market right now is entering a time with a lot of uncertainty especially regarding what yields will look like, the overall consensus seems to be that yields will be off the highs estimates this summer but it still looks to be an average to slightly above average crop in many key growing areas. The extent of the damage caused by the Iowa Derecho will become more known over the next several weeks as well. Add in an election, and increased concerns of another wave of COVID-19 to the mix and it is gearing up to be a very interesting and potentially volatile fall for both commodities and stocks.

In technicals, the market reached prices not seen since March when it was in a tailspin following the onset of the COVID-19 pandemic and the collapse of crude oil. The next level of resistance on any rebound following today would be Friday’s close of $3.7525, beyond that the mid $3.80s is chart resistance. Should the selloff continue as we enter harvest, the obvious downside target would be the gap in the chart from $3.45-$3.48 December futures. Before that level though there is support at the $3.60 level, which is also the 200-day moving average.

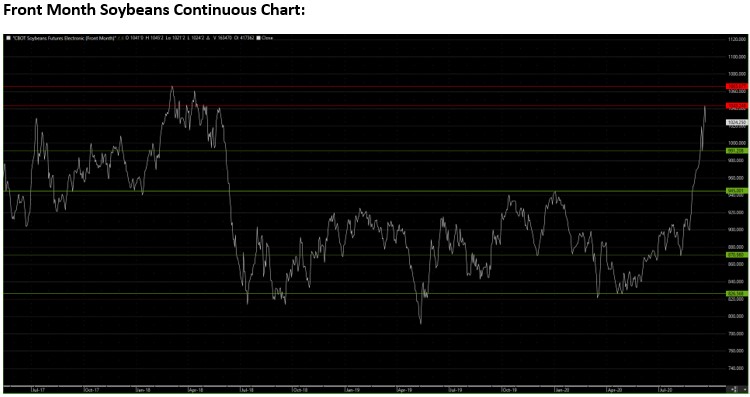

Soybeans

Soybeans also dropped lower to start the week with November soybeans trading 21c lower, closing at $10.2250.

Like corn, soybean futures are very overbought in the short term as futures had rallied $1.80 since August 12th. The managed money fund position hit 200K contracts long last week and looking at historical levels that is a spot where traders begin to take profits on their positions and chip away at their long.

Also, like corn, beans are facing a lot of unknowns that will begin to take shape in the coming weeks and months. The export program to China is obviously one of the biggest stories in beans day to day. The U.S. continues to make sales to China more or less on a daily basis at this point, but with Brazil gearing up to plant more soybean acres this fall, it will be interesting to see how China reacts to a potentially vast South American crop come next Spring. Obviously they will source a good deal of their beans from Brazil at that point but it is critical to the U.S. soybean balance sheet that the U.S. export its “allotment” to China, which given the current estimates would be about 34 MMT, or about 1/3 of China’s import program. The Phase One Trade Agreement seems to be the most likely way this level can be reached but it will also be important to watch Brazilian weather, as well as the U.S. dollar vs the Brazilian Real all play a role in the economics behind how China will make its decisions in the next several months.

In technicals, beans broke through any and all resistance over the past 30+ days on their $1.80 rally. Looking at the continuous chart you must go back to May of 2018 to find front month futures at $10.40+, pre- Trump/China tariffs!! Any continuation of the rally would be met with resistance at $10.60, the high in April of 2018. To the downside, support will be at the $10 level as well as below that at $9.83ish.