Special Market Update

Grain Market Commentary

Monday, June 14, 2021

by Rhett Montgomery, Associate Merchant, The Andersons

Corn and Soybeans

It was a risk off trading session to start the week in grains as both corn and beans were down heavy Sunday night and stayed down throughout the day session Monday. For corn, old crop corn traded down 25.25c, closing at $6.5925. New crop December corn traded down 28.5c, closing at $5.8125. Meanwhile old crop July soybeans traded down 36.25c, closing at $14.7225. New crop soybeans closed at $13.9525, down 43.5c. Weather models Sunday for the next 10-14 days show rain coverage throughout the Midwest and this was the main catalyst for the selloff to start the week. The trade is looking for crop conditions to decline in this afternoons report, off the 72% good/excellent rating from last Monday. This data will reflect the period of dryness over the past 2-3 weeks across much of the Midwest, but the trade today indicates that traders expect the rains over the next 10-14 days to be very timely in terms of abating widespread crop stress issues. The decline in soybeans today can also be attributed to weakness in the soy oil market stemming from concerns regarding blending mandates under the Biden administration.

The market was quick to trade through the WASDE report last week which saw the corn carryout trimmed on both old/new crop, and the bean carryout increased on both old/new crop. Otherwise, the market patiently awaits the June 30th acreage and stocks report. The consensus is that there will be an increase in the corn/bean mix, but the big question is how much and how much is corn vs. beans. Estimates for corn acres are all over the place, I have read numbers anywhere from 92M acres (a slight increase from the USDA March estimate) all the way up to 96-97M corn acres (5-6M acres increase). Soybean acreage estimates are less widespread with most numbers I see looking for a 1-2M increase. Obviously, these acreage numbers carry huge implications to the balance sheet as each million added equals 179M bushels of corn, and 50M bushels of beans to account for in 2021/22. Weather will have to cooperate in July and August, but the Sunday night combination of impending supply increase combined with rain in the forecast was enough to put the markets in a tailspin to start the week.

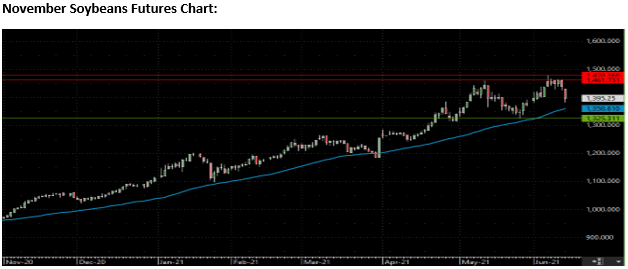

Overall, the last few weeks of June ahead of the acreage report are setting up to be very volatile. It is worth noting that last week November soybean futures averaged a trading range of approximately 33.5c high/low while December corn futures averaged 20c high/low range. I would expect this volatility to continue as weather models change and traders’ position around a wide range of acreage mixes at the end of the month.

In corn technicals, looking at the Dec 2021 board the market failed to hold above the $6.00 mark after an encouraging end to the week last week. The gap from $5.93-5.9275 was the downward target from there and it was filled and then some. The market did manage to stay a dime off of the lows by the close but overall, the market does have some room to the downside yet before it hits clear technical support. Any further slip to the downside has support at today’s low of 5.7050, beyond that the 50-day moving average has been stout support through the entire rally dating back to last August, it currently sits at $5.54. A move back to the upside from here would be met by resistance at the gap from $5.98 to Friday’s close of $6.09, the $6.00 round number mark will also be a key level to watch during any potential rally.

In soybean technicals, looking at the November bean chart, the market failed to hold above $14.00 futures after fighting back above that level halfway through the day session today. To the downside, there is support in the mid to low $13.80s, beyond that the May 26th low of $13.25 is a downside target for any continued selloff. To the upside, the market set a contract high a week ago today at $14.80 on the board, before settling into a range from $14.30 to $14.60, that range would provide upside resistance on any move upwards. However, to challenge the highs again we will need some sort of fundamental story in the form of demand or weather to excite the bulls.