Weekly Market Wrap-Up

Grain Market Commentary

Friday, August 21, 2020

by Jordan Morris, Senior Originations Merchant, The Andersons

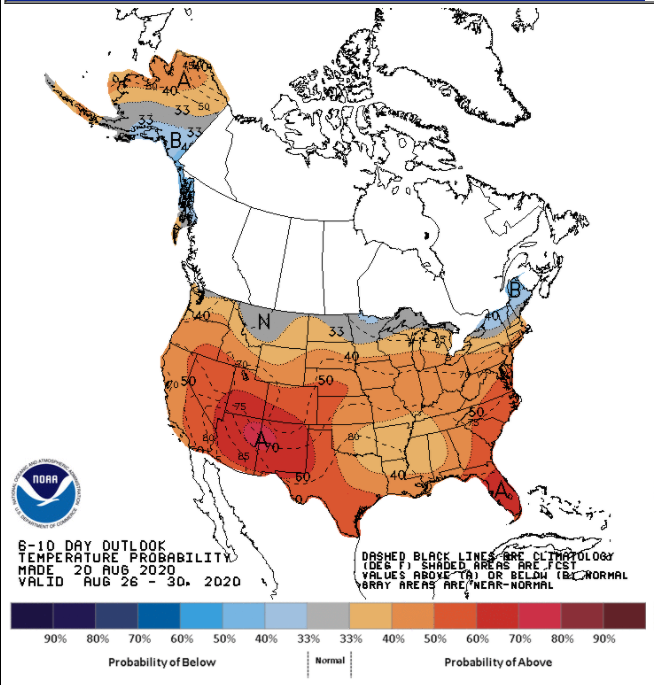

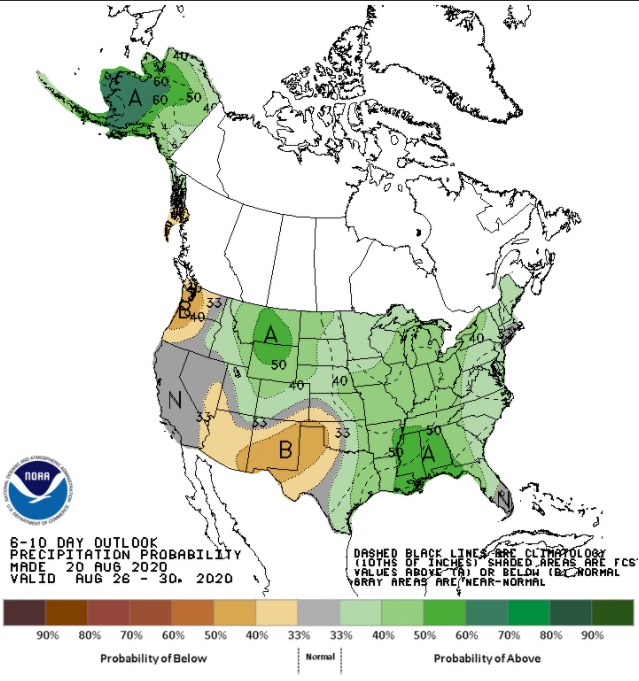

Overall, this week had a nice tone to it. Lots of moving parts have been pushed into the market since the open on Sunday night, and it responded relatively well. We continue to see export sales daily, the Pro Farmer Tour wrapped up last night, last week’s derecho damage estimates continue, and hour by hour weather forecasts are all hot topics impacting new crop grain pricing.

Demand for the crop might be the most important part of the whole equation. The US continues to do fine there, albeit later in the year, but all in all, the sales nowadays are nice to see. Export inspections this week were 407k mt of wheat, 1.19 mil mt of corn, and 899k mt of beans. Corn and soybean inspections beat their 4-week shipment average by around 20%. Net new crop sales were 723k mt of corn and 2.573 mil mt of beans. Mexico was the largest corn buyer, while China again dominated the bean purchases.

The annual Pro Farmer Tour started this week and completed their final legs last night. Corn in Minnesota gained the most notoriety with a statewide yield estimate at 195 bpa. The other states toured are South Dakota, Nebraska, Iowa, Illinois, Indiana and Ohio. Those 5 states combined averaged 180.3 bpa. Bean pod counts appear to be higher than a year ago. The USDA predicted a record US bean yield of 53.3 bpa last week, and the pod counts do not make that look unrealistic. Indiana and Nebraska lead the way in pod counts at 1281 and 1297, respectively. Damage in Iowa was certainly noted, and the yield in the damage zone will definitely lag. Overall, Pro Farmer predicted Iowa’s statewide corn yield at 177.8 with bean pod counts were 1146.

Technicals on the charts could be the place to turn in the next few days if news becomes stale. December corn made a strong move after last week’s USDA report and damaging weather in Iowa provided a spark to the corn trade. After making a new low, corn moved quickly to the 61.8% Fibonacci retracement level. Current December corn is holding firm above the 100-day moving average, and just beneath the high for the week made on Tuesday.

Beans are much stronger with respect to the charts. Last week’s move finally pushed beans above the 200-day moving average for the first time since early January. Then extending that rally this week. A slight draw back the last 2 days cannot be viewed as a negative quite yet. The 200-day moving average at 9.01 will be support. A move below 9.01 would be a bearish signal.

Have a great weekend.