Weekly Market Wrap-Up

Grain Market Commentary

Friday, August 7, 2020

by Jordan Morris, Senior Originations Merchant, The Andersons

The focus this week has been the retreating corn market making new lows and a bean market that just can’t move thru 9.00 sx20.

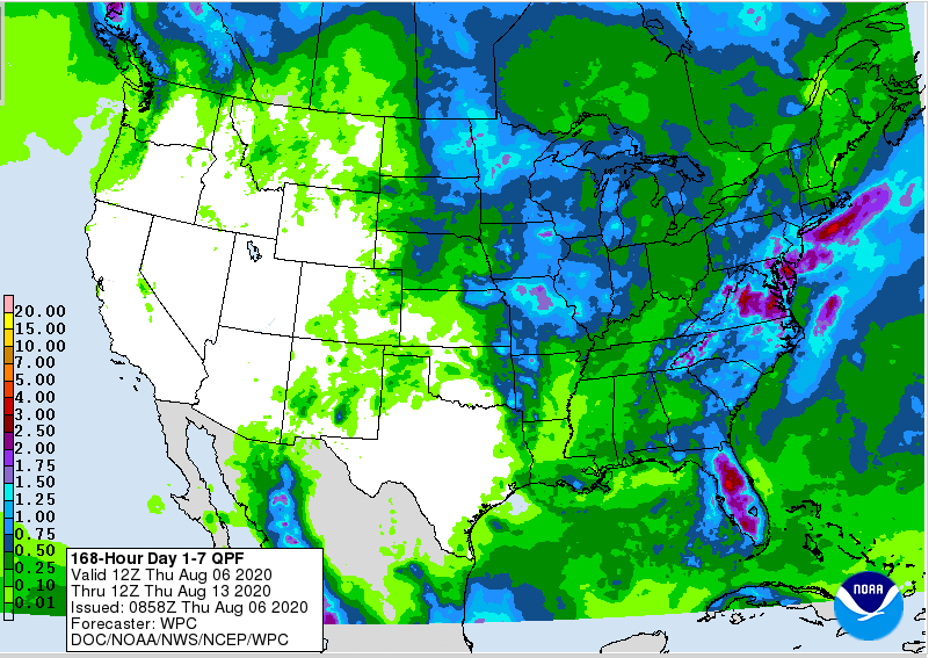

Weather conditions and lack of production fear are keeping the trade from pushing either contract forward. The corn chart might look bleak, but CZ20 corn is in oversold territory as it makes a new low. The last few sessions have been classic risk off trades. The strenghth indicators are hinting that the selling pressure could start to slow. Selling opportunities need to be considered on any type of rally from the currentl 3.20 cz20 area lows. Your next level of interest could be around 3.37 cz20, the 50 day moving average.

Monday saw corn conditons at a lofty 72% good/excellent rating, beans condition ratings improved 1% week/week to 73% good/excellent. Corn silking and in dough stage increased week/week, at 92% and 39%, while beans blooming and setting pods increased to 85% and 59%. Certainly all of that are conducive to producting what the US farmer intended to grow. Big bushels are certainly possible yet again.

Bean export sales have been announced a few times this week. The Chinese business continues to blossom. Export sales business that took place last week was very good. 2.6 mil metric tons of new crop corn and 1.4 mil metric tons of beans were sold. China took the largest chunk of each. Mexico was a close second in terms of new crop corn and bean tonnage purchased.

With a few positives in the market, the overwhelming issue is supply. Be mindful of what is stacked up and how that will impact future rallies. What might seem noteworthy during a more typical marketing year, might be muted to a degree with much different situations in the 2020/21 crop year.

Futures closes on Friday

CU20 – 3.0775 down .035 on the day / down .0825 for week

CZ20 – 3.2075 down .03 on the day/ down .0625 for week

CZ21 – 3.6075 down .02 on the day / down .0175 for week

SX20 – 8.675 down .105 on the day / down .25 for week

SX21 – 8.8525 down .0975 on the day / down .135 for week

WU20 – 4.955 down .0575 on the day / down .3575 for week

WN21 – 5.215 down .0375 on the day / down .275 for week