Weekly Market Wrap-Up

Grain Market Commentary

Friday, February 19, 2021

by Jennifer Klindt, Account Representative, The Andersons

The week started off on Monday evening with trade higher due to subzero temps and potential winterkill damage for the US wheat crop. The overnight rally lost ground by morning, but regained strength by the close of Tuesday’s trade. March corn futures closed the day at $5.5225, up 13.5 cents. March soybean futures closed the day at $13.8475, up 12.75 cents. Funds were credited with buying 30,000 corn contracts throughout the session. Trade is awaiting 2021 crop yield and acreage estimates from The USDA Ag Forum, which will be released later in the week. South America weather remains mixed.

Trade on Wednesday remained mixed with light volume. No new flash sales have been released, as China and Brazil remain on holiday through the end of the week. Many logistical concerns of US exports slowing due to cold temperatures, power issues, and ice on the rivers. March corn futures closed 0.75 cents higher at 5.53. March soybean futures closed 1 cent lower at 13.8375. The trade is still eyeing South American weather as Argentina remains dry and Brazil experiences harvest and second crop planting delays due to wet weather.

Thursday’s trade marked another rangebound session. The Ag Forum released 2021 crop acreage estimates at 92 million acres for corn, in comparison to 90.8 million last year. Estimates for soybeans were marked at 90 million acres, in comparison to 82.3 million last year. Corn acreage projections are in line with last year’s plantings, but soybean acreage projections show a bump. March corn futures closed the day at 5.5025, down 2.75 cents. March soybean futures closed the day at 13.75, down 8.75 cents. Weekly ethanol production reported a decline for the week. Corn and soybean exports remain slow. More Ag Forum data to be released Friday regarding yields and demand.

Trade on Friday started off higher but couldn’t hold through the close of the session. March corn futures closed 7.5 cents lower at 5.4275. March soybean futures closed 2.25 cents higher at 13.7725. The USDA Ag Forum released a 179.5 bu/acre projected yield for corn and 50.8 bu/acre yield for soybeans. Corn exports for 2021 are projected 50 million bushels higher at 2.65 billion bushels, denoting that the export market will remain strong. Soybean outlook remains historically tight with solid exports and crush. Key market factors that will set the tone for future sessions are Chinese demand, South America weather and harvest progress, planting intentions in the United States, and fundamental positioning.

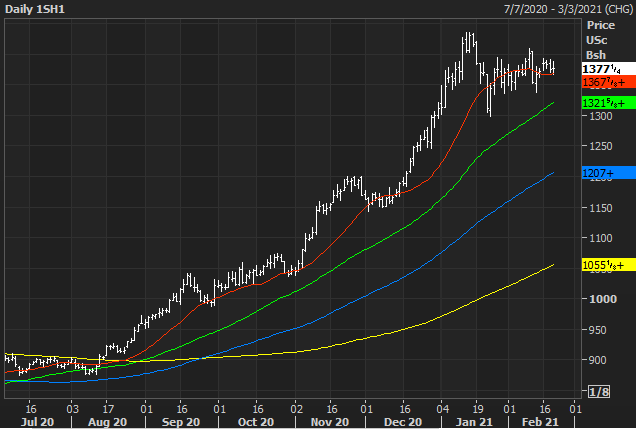

March corn futures opened the week at $5.47 and closed the week at $5.4275, a loss of 4.25 cents.

March soybean futures opened the week at $13.8575 and closed the week at $ 13.7725, a loss of 8.5 cents.

March wheat futures opened the week at $6.48 and closed the week at $6.5075, a gain of 2.75 cents.