Weekly Market Wrap-Up

Grain Market Commentary

Friday, June 18, 2021

by Jennifer Klindt, Merchant, The Andersons

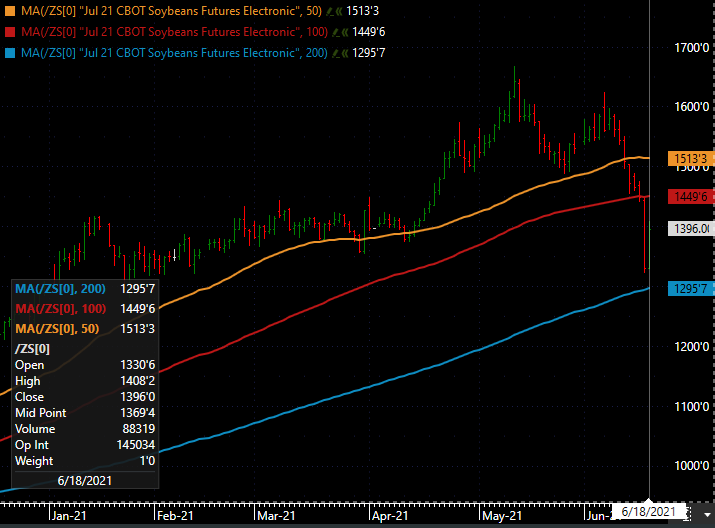

Corn and soybeans suffered losses throughout Monday’s session due to cooler temperatures and rain forecasted in the coming weeks. July corn futures closed the day 25.25 cents lower at $6.5925. July soybean futures closed the day 36.25 cents lower at $14.7225. Rumors circulated of the Biden Administration easing biofuel blending requirements for refiners, leading to decreased demand for corn and soybeans. Monday’s export inspections came in on the low end of trade expectations, with soybeans below trade expectations. Crop Progress marked corn conditions as 68% good to excellent and soybean conditions at 62% good to excellent, both falling from last week’s ratings.

Trade on Tuesday was mixed for corn and soybeans. July corn futures closed the day at 6.6750, a gain of 8.25 cents. July soybean futures closed the day at 14.6575, a loss of 6.5 cents. Weather models still showed above normal precipitation for the Midwest, but concerns remain that the Northern and Western belt may miss out on the rain leading to deteriorating crop conditions. Unanswered questions about RFS enforcement by the Biden Administration led to a continued sell-off in the soybean complex.

Wednesday’s session was marked by choppy trade. Nearby corn futures attracted new buying while soybean futures fell off due to liquidation in soybean oil. The USDA announced a flash sale of 154 tmt of new crop corn to unknown, giving corn trade a further boost. July futures closed the day 5.5 cents higher at 6.73. July soybean futures closed the day 17.25 cents lower at 14.4850. EIA data showed a decrease in ethanol production and an increase in stocks amid strong gas demand.

Trade on Thursday showed significant losses for corn and soybean futures, despite dry conditions for the Midwest. July corn futures closed 40 cents lower at 6.33 and July soybean futures closed 118.75 cents lower at 13.2975. Soybean oil continues to influence downside as concerns remain that the Biden Administration will reduce the biofuel blending mandate. Weather models continue to show increased chances of precipitation and cooler temperatures in the coming week. Export sales data fell on the low end of trade expectations and the U.S. dollar traded higher.

Friday’s trade showed strength for corn and soybeans after Thursday’s sell-off. July corn futures closed the day at 6.5525, a gain of 22.25 cents. July soybean futures closed the day at 13.96, a gain of 66.25 cents. Rumors of China purchasing new crop soybeans lingered throughout the session. Rain and cooler temperatures remain forecasted for the Midwest in the week ahead, but smaller chances for the already dry Western Corn Belt. Weather, demand, acreage estimates, and fund positioning will set the tone for future sessions.

July corn futures opened the week at $6.7575 and closed the week at $6.5525, a loss of 20.5 cents.

July soybean futures opened the week at $15.0425 and closed the week at $13.96, a loss of $1.0825.

July wheat futures opened the week at $6.8050 and closed the week at $6.6275, a loss of 17.75 cents.