Weekly Market Wrap-Up

Grain Market Commentary

Friday, October 22, 2021

by Jennifer Klindt, Merchant, The Andersons

Monday’s trade rebounded to begin the week. Export inspections were favorable for corn and soybeans, both exceeding expectations. Rising values in the energy sector led to firmer soybean futures. Corn futures were lifted by a rally in wheat due to supply concerns. Yields remained good around the Midwest with fair weather ahead for harvest progression. December corn futures closed the day 7 cents higher at $5.3275. November soybean futures closed the day 3.75 cents higher at $12.2150. Monday’s Crop Progress marked corn harvest at 52% complete and soybean harvest at 60% complete nationwide. Corn condition ratings remained unchanged week over week at 60% good to excellent.

Trade on Tuesday displayed weakness for corn and strength for soybeans. Continued upside in oil drove soybean futures higher, along with rumors of Chinese buying. Nearby corn futures faced chart resistance along with harvest pressure. South American production is off to a fair start as Brazil has received recent rainfall, but Argentina remains dry. December corn futures closed the day at 5.3025, a loss of 2.5 cents. November soybean futures closed the day at 12.28, a gain of 6.5 cents.

Wednesday’s session presented upside on rumors that China had inquired about U.S. corn, soybeans, and wheat. Corn futures also rallied on the release of weekly ethanol production data, which showed new highs for the year along with continued strong demand. Soybeans rallied on buying of the oil share. December corn futures closed the day 9 cents higher at 5.3925. November soybean futures closed the day 17.5 cents higher at 12.4550. Fertilizer has also been a continued topic of the trade. With rising fertilizer prices and shipping concerns, 2022 could potentially present less corn and more soybean acres.

Trade on Thursday showed downside led by weaker crude oil and a higher dollar, ultimately leading to a sell-off in soy and palm oil. The USDA confirmed the sale of 130,000 tonnes of corn for delivery to Mexico in 2021/22. Export sales data showed another strong week with corn near the high end of trade expectations and soybeans exceeding expectations. No new soybean sales were announced to China as the trade was expecting. December corn futures closed the day at 5.3225, a loss of 7 cents. November soybean futures closed the day at 12.24, a loss of 21.5 cents.

Friday’s session was mixed to end the week. Corn rallied followed by tightening world supplies and strong demand for wheat. Soybeans trended lower on no confirmation of rumored soybean sales to China along with weakness in soybean oil. December corn futures closed the day 5.75 cents higher at 5.38. November soybean futures closed the day 3.5 cents lower at 12.2050. Rainfall is expected throughout the Midwest this weekend through the middle of next week, slowing harvest progression.

December Corn opened the week at $5.2575 and closed the week at $5.38, a gain of 12.25 cents.

November Soybeans opened the week at $12.18 and closed the week at $12.2050, a gain of 2.5 cents.

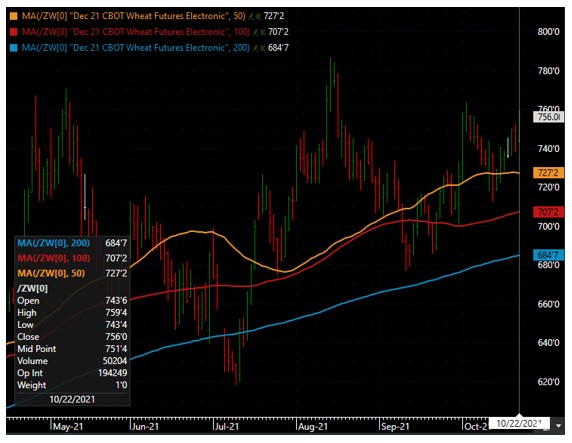

December Wheat opened the week at $7.34 and closed the week at $7.56, a gain of 22 cents.