Weekly Market Wrap-Up

Grain Market Commentary

Friday, January 7, 2022

by Jennifer Klindt, Merchant, The Andersons

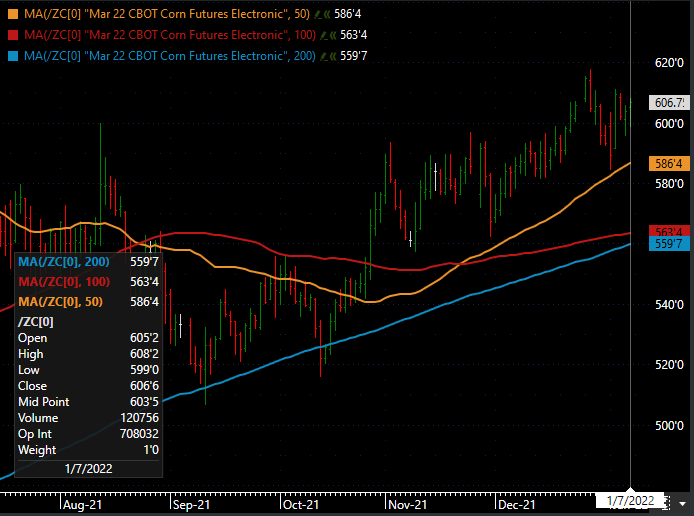

Monday’s session displayed weakness for corn and strength for soybeans to start off the new year. Export inspections revealed corn exports at the low end of trade expectations and soybean exports below expectations. High demand for soybean meal led the soybean complex along with dryness concerns in Argentina and Southern Brazil. StoneX lowered production estimates of both Brazil’s corn and soybean crops. March corn futures closed the day 4 cents lower at $5.8925. January soybean futures closed the day 15.25 cents higher at $13.44.

Trade on Tuesday rallied for all commodity sectors. Fund buying took place as South American weather and production concerns remained a top headline with hot, dry weather forecasted for the next 10 days. Palm oil soared on supply concerns after flooding across Malaysia, leading to upside in the soybean sector with corn following. March corn futures closed the day at 6.0950, a gain of 20.25 cents. January soybean futures closed the day at 13.7875, a gain of 34.75 cents.

Wednesday’s trade showed weakness following Tuesday’s gains. The USDA confirmed the sale of 132,000 tonnes of soybeans for delivery to unknown in 2022/23. Weekly ethanol production data showed a small decline in production and an increase in stocks, reflecting slightly weaker demand. Weather models showed rainfall for Argentina in the 11-15 day forecast, but no relief nearby. March corn futures closed the day 7.25 cents lower at 6.0225. January soybean futures closed the day 5.5 cents higher at 13.8425.

Trade on Thursday was mixed for corn and soybean futures. The USDA confirmed the sale of 102,000 tonnes of soybeans for delivery to Mexico in 2021/22. Soybeans remained under heavy selling pressure throughout the session. Export sales data showed corn, soybeans, and wheat all below trade expectations. Forecasted weather for South America continued to show extreme heat for Argentina, along with dryness concerns for Southern Brazil. March corn futures closed the day at 6.0375, a gain of 1.5 cents. January soybean futures closed the day at 13.7725, a loss of 7 cents.

Friday’s session began lower but recovered mid-session and closed the day higher. The USDA confirmed the sale of 176,784 tonnes of corn to Mexico in 2021/22 and 120,000 tonnes of soybeans to unknown in 2022/23. A surge in soymeal futures led to the close for soybeans above $14 mark. March corn futures closed the day 3 cents higher at 6.0675. January soybean futures closed the day 24.25 cents higher at 14.0150. Key factors that remain are South American weather and positioning ahead of the next USDA report on Wednesday, January 12th.

March corn futures opened the week at $5.99 and closed the week at $6.0675, a gain of 7.75 cents.

January soybean futures opened the week at $13.4025 and closed the week at $14.0150, a gain of 61.25 cents.

March wheat futures opened the week at $7.74 and closed the week at $7.5850, a loss of 15.5 cents.