Weekly Market Wrap-Up

Grain Market Commentary

Friday, May 20, 2022

by Jennifer Klindt, Merchant, The Andersons

Commodities soared on Monday following India’s announcement of a ban on wheat exports due to a heat-induced decline in domestic production along with uncertainty over global supplies. Wheat futures traded limit up as corn and soybeans followed. Weekly export inspections landed within trade expectations for corn and on the high end of expectations for soybeans. Monday’s Crop Progress release pegged nationwide corn planting at 49% complete and soybean planting at 30% complete, both indicating good progress from last week but well behind last year and five-year averages. July corn futures closed the day 28.25 cents higher at $8.0950. July soybean futures closed the day 10 cents higher at $16.5650.

Trade on Tuesday presented weakness for corn and strength for soybean futures. Corn futures fell lower as the trade showed positivity towards Monday’s planting progress with a reasonable planting window and favorable weather ahead. Soybeans rallied on rumors of a possible export sale to China in the works. Brazil’s Safrinha corn crop remained dry with fears of reduced production estimates. July corn futures closed the day at 8.0075, a loss of 8.75 cents. July soybean futures closed the day at 16.78, a gain of 21.50 cents.

Wednesday’s session was marked by liquidation for all commodity sectors due to bearish concerns from macro markets. Corn futures fell as wheat traded near limit lower. Weekly ethanol production data showed steady production week over week with a decrease in stocks. The USDA confirmed the sale of 229,200 tonnes of soybeans to unknown destinations with portions in 2021/22 and 2022/23. July corn futures closed the day 19.25 cents lower at 7.8150. July soybean futures closed the day 15.25 cents lower at 16.6275.

Trade on Thursday rallied for soybeans along with a slight rebound for corn futures. Soybeans traded higher following upside in soybean meal, while soybean oil showed weakness on the news that Indonesia will end its ban on palm oil exports. Weekly export sales data landed on the high end of trade expectations for corn and exceeded expectations for soybeans. Weather remained key for the marketplace as dryness remained in central Brazil, western Europe, and the Southern Plains. July corn futures closed the day at 7.8325, a gain of 1.75 cents. July soybean futures closed the day at 16.9050, a gain of 27.75 cents.

Friday’s session showed pressure for corn futures followed by a sharp fall in wheat due to potential Ukraine exports. Soybeans showed strength led by a recovery in soybean meal and oil along with rumors of Chinese buying interest. July corn futures closed the day 4.50 cents lower at 7.7875. July soybean futures closed the day 14.75 cents higher at 17.0525. Key factors in the week ahead are Monday’s Crop Progress report, U.S. and South America weather, demand, the war between Russia/Ukraine, and fundamental positioning.

July 22 Corn futures opened the week at $7.95 and closed the week at $7.7875, a loss of 16.25 cents.

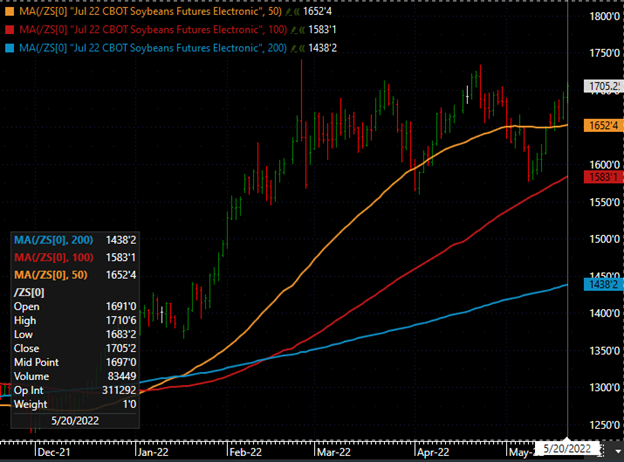

July 22 Soybean futures opened the week at $16.5750 and closed the week at $17.0525, a gain of 47.75 cents.

July 22 Wheat futures opened the week at $12.3425 and closed the week at $11.6875, a loss of 65.50 cents.