Weekly Market Wrap-Up

Grain Market Commentary

Friday, May 27, 2022

by Jennifer Klindt, Merchant, The Andersons

Monday’s trade was mixed to begin the week. Corn futures showed upside following wheat on export concerns out of Ukraine and Russia. Soybean futures fell due to liquidation and weakness in soybean meal. The USDA announced the sale of 130,000 tonnes of soybeans for delivery to Egypt in 2021/22. Weekly export inspections exceeded expectations for corn and landed within expectations for soybeans. Monday afternoon’s Crop Progress revealed planting progress at 72% complete for corn and 50% complete for soybeans, both ahead of trade expectations. July corn futures closed the day at $7.8625, a gain of 7.5 cents. July soybean futures closed the day at $16.87, a loss of 18.25 cents.

Corn and wheat futures were pressured during Tuesday’s session following macro market weakness and fund liquidation. Corn also traded weaker on stronger planting progress than the trade had expected. Rumors circulated throughout the session that China was buying old crop corn from Brazil leading to fears of weaker U.S. exports. July corn futures closed the day 14.50 cents lower at 7.7175. July soybean futures closed the day 6 cents higher at 16.93.

Wednesday’s session was marked by further liquidation but showed partial recovery by the close. China cleared Brazilian corn for import causing trade concerns for U.S. competitiveness. Talk lingered throughout the session about Russia allowing Ukrainian exports in exchange for the removal of western sanctions. Weekly ethanol data showed an increase in production with a slight decrease in stocks. July corn futures closed the day at 7.7225, a gain of 0.50 cents. July soybean futures closed the day at 16.81, a loss of 12 cents.

Corn futures fell on Thursday while soybean futures soared. Soybeans rallied on strength in crude oil, wet planting weather for the Northern Plains, and fund repositioning. Weekly export sales data came in on the low end of expectations for corn and soybeans with old crop corn sales at a marketing year low. July corn futures closed the day 7.25 cents lower at 7.65. July soybean futures closed the day 45.50 cents higher at 17.2650.

Friday’s session showed upside to close off the week ahead of Memorial Day weekend. Concerns linger in the Black Sea as chances of Russia helping open Ukrainian ports remain slim. July corn futures closed the day at 7.7725, a gain of 12.25 cents. July soybean futures closed the day at 17.3225, a gain of 5.75 cents. Influential market factors for next week’s trade include planting progress, U.S. and South America weather, Russia/Ukraine export tensions, demand, and fundamental positioning.

July 22 Corn futures opened the week at $7.8025 and closed the week at $7.7725, a loss of 3 cents.

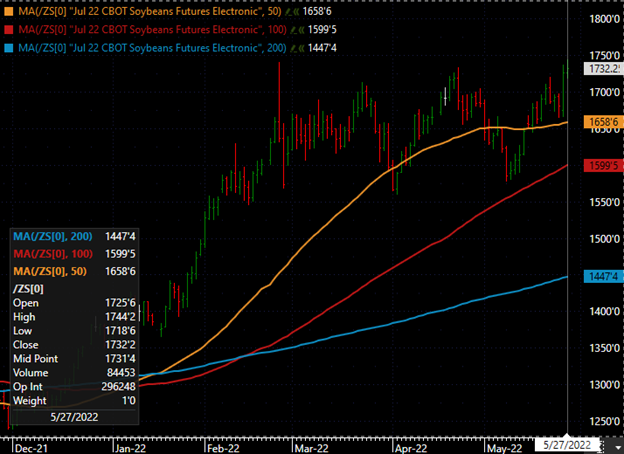

July 22 Soybeans futures opened the week at $17.06 and closed the week at $17.3225, gain of 26.25 cents.

July 22 Wheat futures opened the week at $11.8175 and closed the week at $11.5750, a loss of 24.25 cents.